If you are interested in crypto exchange software development, you probably already know that a cryptocurrency exchange is a business — online or otherwise — enabling its customers to trade both digital and traditional fiat currencies. In recent years, the decision to create a crypto exchange platform has become increasingly enticing for a variety of organisations. After all, in spite of the market’s volatility, many exchanges including Crypto.com, Kucoin and Binance have become extremely profitable. Yet replicating this level of success is not without its unique pitfalls and challenges, as there are a number of security issues that must always be borne in mind.

Thankfully, by understanding the core components of blockchain exchange development — and coming up with a thorough game plan — you can successfully build cryptocurrency exchange software both iterative and inexpensively.

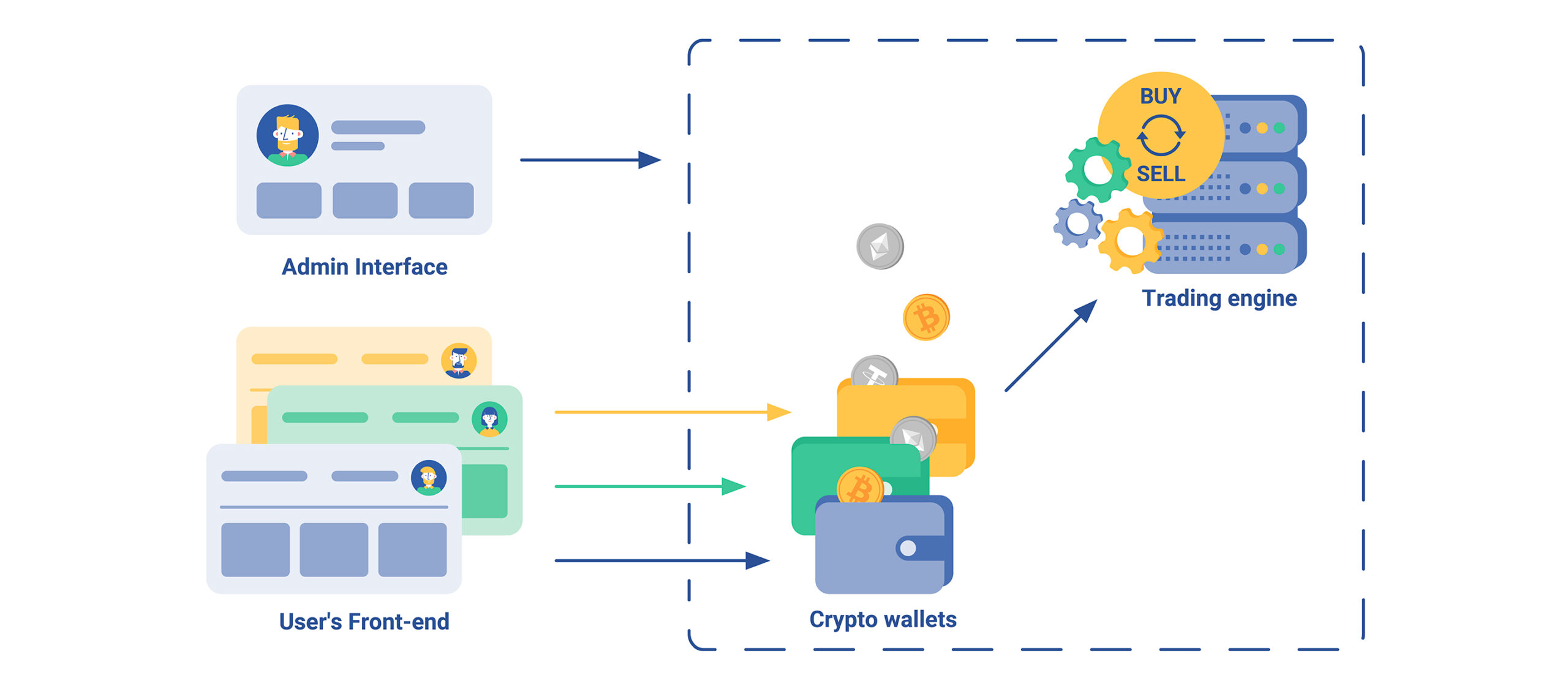

A Look at the Cryptocurrency Exchange Architecture

With that in mind, for companies determined to start a cryptocurrency exchange project of their own, it is important to seek a software vendor that can design the blockchain application architecture.

When broken down into its core components, a crypto exchange product is composed of up to four individual modules: a trading engine, a cryptocurrency wallet, a front-end user interface and an admin console.

Trading Engine

The trading engine — which includes the order book and order processing — is the beating heart of the crypto exchange product. Its main purpose is to execute transactions, calculate balances and match buy and sell activity within the exchange application. Because this module will simultaneously process multiple transactions, it is essential that it be error-free as well as technically efficient.

Crypto Wallet

The cryptocurrency wallet is of similar importance. This is where all of the user’s tokens and deposits are intended to be securely stored. The key term here is “securely,” as for all intents and purposes, online assets should be treated as cash.

User Interface & Admin Area

Next, beyond the need to create a blockchain application architecture, as the face of your application and business, the front-end user interface must also be given considerable attention. And finally, an admin console will also be needed to assist companies with operational tasks. This will encompass the options to manage listings, edit trading fees, add or remove currencies, credit and debit funds from a user’s wallet and deal with any or all potential support issues.

Please note that in order to protect the system from criminal activity, fraud and cyberattack protection measures and modules might also have to be put in place.

The Baseline Assumption

For all of the values outlined below, we have assumed that your crypto exchange product will be developed by a team of three software engineers

MVP

Because crypto exchanges are particularly complex applications, there are a few key pieces of functionality that will have to be present in a minimum viable product (MVP).

Hire Experts in Blockchain-based development

SPG, we can help your company build the most popular types of exchange applications:

- Create a decentralised exchange platform (DEX)

- Create a centralised exchange platform (CEX)

- Create a hybrid exchange platform

Additional functionality

Building upon your initial MVP, additional features including integration with third-party services (bank cards, electronic wallets, hardware wallets, etc.) might also be implemented. This takes place as and when required, as Agile companies — including Software Planet Group — are able to gradually enhance their applications in flexible iterations prioritised by the customer:

| MVP | Epics | Complexity Units | Estimate, man*weeks |

|---|---|---|---|

| System should handle block transactions | 4 | 4 | |

| System should store and display the trading history | 3 | 3 | |

| Users should be able to register, provide KYC information and log in | 2 | 2 | |

| User should be able to make and manage deposits | 3 | 3 | |

| User should be able to make and manage orders | 2 | 2 | |

| User can access trading history | 2 | 2 | |

| User can get notifications via email (messaging system) | 2 | 2 | |

| Administrators can log in (with 2FA) | 1 | 1 | |

| Administrators can manage the platform's users | 2 | 2 | |

| Administrators can review the platform's statistics | 2 | 2 | |

| Administrators can manage the fee structure | 2 | 2 | |

| System can monitor its performance and perform actions/alerts | 2 | 2 | |

| System can display a landing page with a ticker and manuals/FAQ (CMS) | 2 | 2 | |

| System can provide the API for automated trade and integration | 3 | 3 | |

Total: | 32 |

Why Not Create a Crypto Exchange With SPG?

So there you have it! All in all, if you are ready to create a decentralised exchange, the total time to create a DeFi crypto exchange product (for a standard team of 3 software developers), runs at approximately 32 weeks.

In any case, at Software Planet Group, not only can you find top web 3.0 developers with an established history of developing financial systems, but you can work with an experienced team of blockchain developers who will enable you to achieve your lofty objectives.